All Categories

Featured

Table of Contents

As recognized investors, individuals or entities may participate in exclusive investments that are not registered with the SEC. These investors are presumed to have the economic elegance and experience required to review and spend in high-risk financial investment chances inaccessible to non-accredited retail financiers. Right here are a few to think about. In April 2023, Congressman Mike Flooding presented H (investment opportunities for accredited investors).R

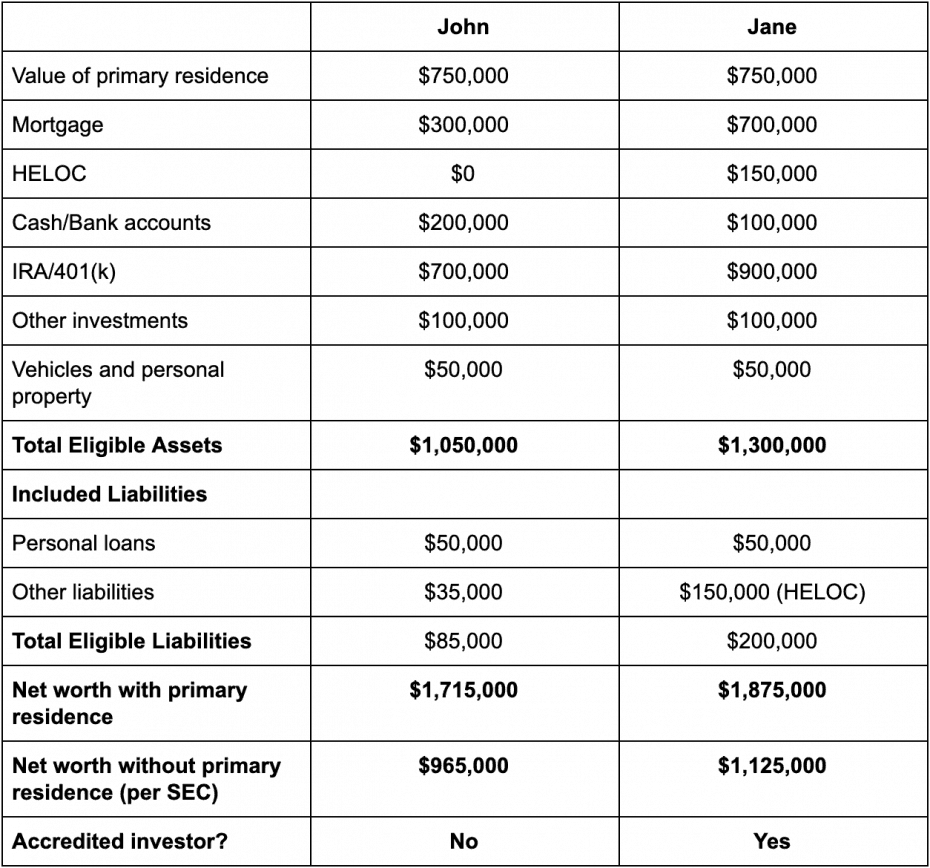

For currently, financiers should follow by the term's existing definition. Although there is no formal procedure or federal certification to come to be an accredited investor, a person may self-certify as an approved financier under present regulations if they made even more than $200,000 (or $300,000 with a spouse) in each of the past 2 years and expect the exact same for the current year.

People with an active Series 7, 65, or 82 permit are additionally thought about to be recognized investors. Entities such as firms, partnerships, and depends on can likewise attain recognized financier status if their investments are valued at over $5 million.

Here are a few to think about. Personal Equity (PE) funds have shown impressive growth in recent times, apparently undeterred by macroeconomic challenges. In the third quarter of 2023, PE deal volume exceeded $100 billion, approximately on the same level with bargain activity in Q3 of the previous. PE firms swimming pool funding from approved and institutional investors to obtain managing interests in mature private firms.

In addition to funding, angel financiers bring their professional networks, assistance, and competence to the startups they back, with the expectation of venture capital-like returns if the organization takes off. According to the Center for Venture Research, the ordinary angel investment amount in 2022 was roughly $350,000, with capitalists getting an ordinary equity risk of over 9%.

Value High Yield Investments For Accredited Investors Near Me – Austin

That said, the advent of on-line personal credit rating platforms and niche enrollers has made the asset class accessible to individual recognized investors. Today, financiers with as little as $500 to spend can capitalize on asset-based personal credit rating possibilities, which provide IRRs of as much as 12%. Despite the increase of ecommerce, physical supermarket still make up over 80% of grocery store sales in the United States, making themand specifically the property they run out oflucrative investments for certified investors.

In contrast, unanchored strip centers and neighborhood centers, the following 2 most greatly transacted kinds of real estate, recorded $2.6 billion and $1.7 billion in transactions, specifically, over the exact same period. But what are grocery store-anchored centers? Suv shopping center, outlet shopping centers, and various other retail facilities that include a major food store as the area's primary renter typically fall under this classification, although shopping malls with enclosed sidewalks do not.

To a lower extent, this phenomenon is also real in opposite. This distinctly cooperative partnership between a facility's tenants drives up demand and keeps rents raised. Certified financiers can spend in these rooms by partnering with realty private equity (REPE) funds. Minimum investments generally begin at $50,000, while overall (levered) returns range from 12% to 18%.

Dynamic Accredited Investor Opportunities Near Me

The market for art is additionally expanding. By the end of the years, this figure is expected to approach $100 billion.

Investors can now have diversified private art funds or acquisition art on a fractional basis. These options feature financial investment minimums of $10,000 and use net annualized returns of over 12%. Financial backing (VC) proceeds to be just one of the fastest-growing property courses worldwide. Today, VC funds boast greater than $2 trillion in AUM and have actually deployed more than $1 trillion right into venture-backed startups considering that 2018including $29.8 billion in Q3 2023 alone.

Over the past a number of years, the recognized financier definition has actually been criticized on the basis that its sole concentrate on an asset/income test has unfairly excluded almost the wealthiest people from financially rewarding financial investment opportunities. In feedback, the SEC started taking into consideration methods to expand this interpretation. After an extensive comment duration, the SEC adopted these amendments as a way both to catch individuals that have trusted, different indicators of monetary sophistication and to update certain out-of-date parts of the meaning.

The SEC's main issue in its guideline of non listed safeties offerings is the security of those investors that lack an enough degree of financial refinement. This issue does not relate to knowledgeable staff members due to the fact that, by the nature of their placement, they have adequate experience and accessibility to financial info to make informed financial investment choices.

Reliable 506c Investment Near Me – Austin Texas

The establishing factor is whether a non-executive worker in fact joins the exclusive financial investment firm's financial investments, which need to be figured out on a case-by-case basis. The addition of well-informed workers to the certified capitalist interpretation will certainly additionally enable more workers to purchase their employer without the private financial investment company risking its very own status as an approved financier.

Before the changes, some exclusive investment firm risked losing their accredited investor standing if they allowed their staff members to buy the company's offerings. Under the modified definition, a better number of private financial investment business staff members will certainly now be eligible to spend. This not just develops an added resource of capital for the private investment firm, yet additionally more aligns the passions of the staff member with their company.

Effective Real Estate Accredited Investors – Austin

Presently, only people holding specific broker or financial expert licenses ("Series 7, Collection 65, and Collection 82") qualify under the meaning, however the amendments give the SEC the capacity to consist of extra accreditations, designations, or qualifications in the future. Particular types of entities have additionally been contributed to the meaning.

When the definition was last upgraded in 1989, LLCs were relatively uncommon and were not consisted of as an eligible entity. Under the modifications, an LLC is taken into consideration a recognized capitalist when (i) it has at least $5,000,000 in properties and (ii) it has not been developed entirely for the details objective of acquiring the safeties provided.

Similarly, specific household workplaces and their clients have actually been included to the definition. A "household workplace" is an entity that is developed by a family members to handle its properties and offer its future. To make certain that these entities are covered by the interpretation, the changes mention that a family workplace will certainly now qualify as an accredited financier when it (i) takes care of at the very least $5,000,000 in possessions, (ii) has actually not been created specifically for the purpose of getting the offered safety and securities, and (iii) is directed by an individual who has the economic elegance to assess the qualities and dangers of the offering.

The SEC asked for remarks regarding whether the monetary limits for the earnings and property examinations in the interpretation ought to be changed. These limits have actually remained in area because 1982 and have not been adapted to represent rising cost of living or various other aspects that have actually changed in the intervening 38 years. The SEC inevitably chose to leave the property and income limits unchanged for now (growth opportunities for accredited investors).

Latest Posts

What Is A Tax Lien Foreclosure

Tax Foreclosures Property

Tax Lien Investing Software